If you’re a devoted yogi who’s looking to change up your routine, then Toronto offers a variety of unique studios just for you. Whether you’re seeking a new […]

Toronto's Fashoin

City Destinations & News

Best Toronto Neighborhoods

A List of Summer Camps in Toronto to Attend in 2024

Camp Kandalore Camp Kandalore has been delivering a unique overnight camp experience for campers aged 6 to 16 for over 75 years. Combining the best of canoe-tripping and […]

How to Navigate the Neighborhoods of Toronto

Toronto is a city that’s often hailed as Canada’s counterpart to Manhattan, and it stands as a dynamic city nestled along the shores of Lake Ontario. As the […]

Shopping Destinations that You Should Visit While in Toronto

Toronto has emerged as a key shopping destination in North America in recent years. The city’s diverse neighborhoods showcase a variety of styles that cater to a range […]

Best Cycling and Hiking Routes in the Greenbelt to Help You Take Care of Your Mental Health

As Toronto enters the summer, prioritizing mental and physical well-being is crucial. A recent survey by the Canadian Mental Health Association (CMHA) and the University of British Columbia […]

5 New Spots to Practice Reformer Pilates in Toronto

Reformer Pilates is slowly making a comeback lately, thanks to TikTok trends and celebrity endorsements from figures like Harry Styles and Kim Kardashian. Distinguishing itself from mat-based Pilates, […]

4 Secret Tips that You as a Man Can Do to Improve Your Overall Health

As a man, when was the last time you prioritized your well-being? If you’re like many men, taking care of your physical and mental health might not be […]

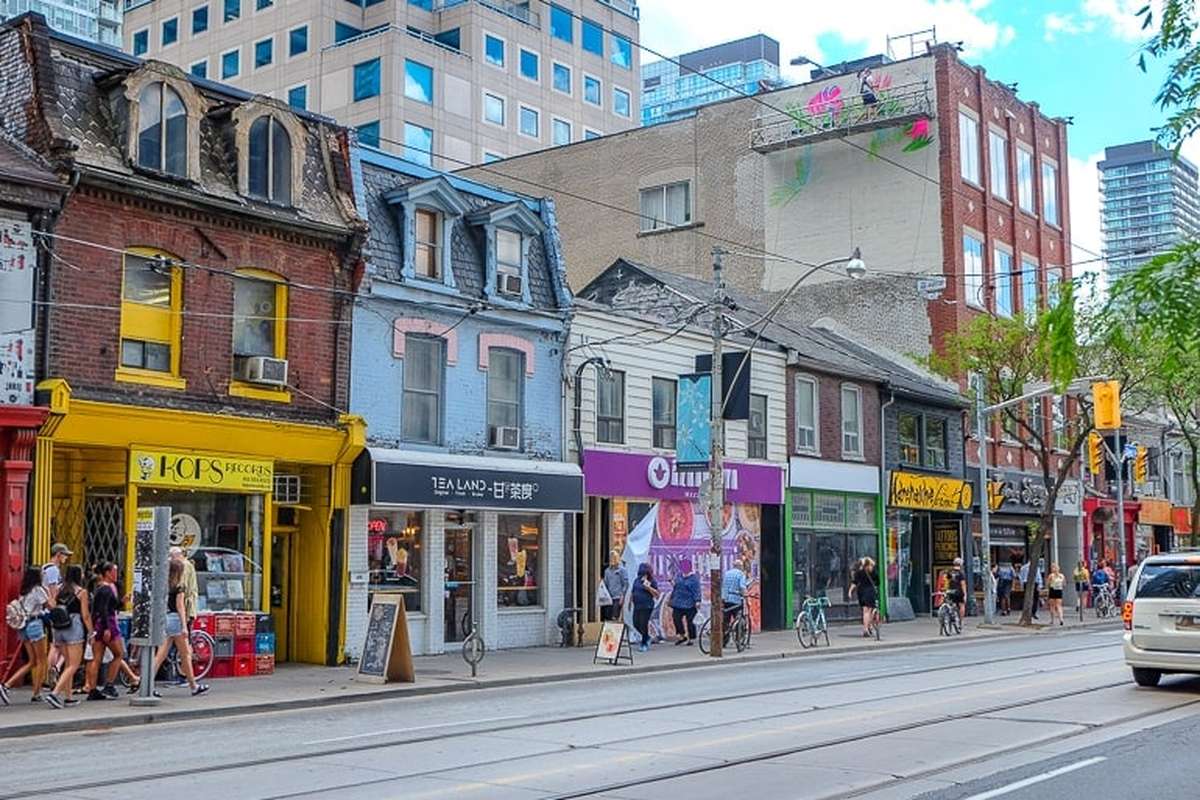

The Best Neighborhoods in Toronto that You Should Definitely Visit

In Toronto, you can come across diverse neighborhoods that offer distinct styles, vibes, and scenes. Whether you’re exploring a bustling shopping district in the morning, experiencing a historic […]

How Toronto Aims to Remedy the Housing Crisis

Toronto is currently grappling with crises in climate and housing. To resolve such issues, the city aims to achieve net-zero emissions community-wide by 2040 to address the climate […]

Tips for Dealing with the Most Common Nutrient Deficiencies

Frequent tiredness, pain, anxiety, brain fog, insomnia, irregular heartbeat, hair loss, or infections are conditions that a lot of people experience. When an individual approaches a nutritionist with […]